Observations on the Endowment Model

David Swensen made a radical change to Yale’s endowment in the 1980s and 1990s. He dramatically reduced Yale’s exposure to the traditional asset classes of stocks and bonds and shifted the portfolio into alternative assets like private equity, venture capital, and absolute return hedge funds.

Swensen wrote about this strategy in his 2000 book Pioneering Portfolio Management. His ideas were revolutionary at the time. But, nearly 20 years later, it is hard to find a large asset pool that has not mimicked the “Yale Endowment Model” that Swensen originated.

Swensen’s returns were (and continue to be) phenomenal, and many tried to mimick his strategy by increasing allocation to alternatives. It’s hard to identify an endowment today that has not mimicked the

“Yale Endowment Model” of the 90s and early 2000s today to some degree.

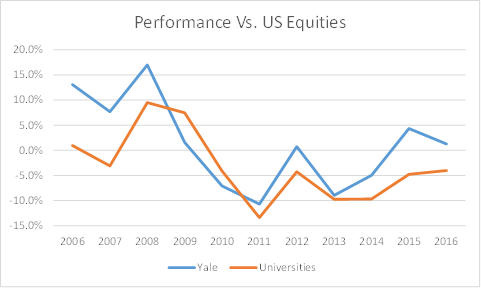

But the post-crisis era has not rewarded the herd of endowment model copycats. College endowments once outperformed the broad equity market by a significant margin, but that has not been true in recent years.

Figure 1: Performance of University Endowments vs. Broader US Equity Markets

Source: Yale, NACUBO, Vanguard Total Stock Market Index

University endowments underperformed the broader US equity market every year from 2010-2016. Yale underperformed in four of those seven years. The compounded returns of both Yale and the broader set of universities have lagged broad US equity markets. But why?

The alternative investments that characterized the “Yale Model” simply did not fare well relative to US equity markets. Over the most recent five years from 2011-2016, venture capital* was the only alternative asset class to outperform US equities. Private equity (as we have discussed in previous research notes) underperformed the broader US equity market as did absolute return hedge funds.

Figure 2: Returns of Alternative Asset Classes

The historical advantage of investing in alternatives has diminished as investors have flooded these asset classes with capital. Renowned investor David Salem’s explanation for this phenomenon is that investors confused Swensen’s tactics (a shift to alternatives) with his philosophy (do uncomfortable and unusual things that others are unwilling to do. “How has the so called endowment model which is really an adaptation of the Yale Model become overused? It’s been the polar opposite of a willingness to be wrong and alone, it’s a proclivity and tendency to just chase recent returns and put money where others have put it and continue to put it because it’s comfortable. That’s the endowment model in 2017.”

* The track record of venture capital may look like a bright spot, with continued outperformance over a five and ten year period. But we are skeptical of whether these returns are real. The distributed-to-paid-in ratio of every venture capital vintage year since 2007 are below 0.74, meaning that the majority of the great performance numbers that venture capital funds are showing are based on the venture capital funds’ own valuations of the companies they own. We think investors shouldn’t necessarily take these returns to the bank.