Skin in the Game

Most active managers fail to beat the markets. But what does academic research say about those funds that do?

Academic literature supports the conclusions that the small funds outperform the large, the new outperform the old, low-fee funds outperform the high-free funds, and those who diverge from the index outperform those who engage in crowded trades. And now a new paper is hot off the presses that adds a fascinating new predictive factor: the degree to which having skin in the game predicts fund managers’ performance.

Researchers at NYU and Columbia Arpit Gupta and Kunal Sachdeva find that “funds with greater investment by insiders outperform funds with less ‘skin in the game’ on a factor-adjusted basis; exhibit greater return persistence; and feature lower fund flow-performance sensitivities.”

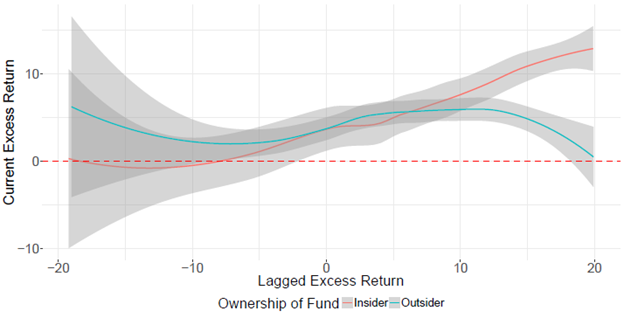

Below is a plot of the excess returns over time of funds managing insider capital versus outside capital. The results suggest a striking divergence in performance between managers with skin-in-the-game and those without after about one year.

Figure 1: Return Predictability of Funds by Insider Status

Source: Arpit Gupta and Kunal Sachdeva “Skin or Skim? Inside Investment and Hedge Fund Performance” 7 June, 2017. Note: Insider funds are those with > 20% Inside Investment. The grey portions correspond to the 95% confidence intervals.

The more general operative logic behind the phenomenon is as ancient as scholarship itself. Around 400 BC, Aristotle critiqued Plato’s view of communal ownership of assets and family, arguing that, under such a utopian system, “each citizen will have a thousand sons who will not be his sons individually but anybody will be equally the son of anybody, and will therefore be neglected by all alike […] For that which is common to the greatest number has the least care bestowed upon it.”

In contrast, Dan and I have the vast majority of our net worth invested in the funds we manage. To paraphrase folk wisdom, we have put all our eggs in one basket and are watching that basket very closely.

Exactly why we see this divergence in performance, however, may require a bit more nuanced of an explanation. One reason is the phenomenon of crowded trades. As funds get larger, many strain to invest all of their new capital in their original strategy, given that sometimes the most strategically advantageous stocks are not the ones with sufficient trading volume. Large fund managers seeking to put billions of dollars to work in the market often times end up buying portfolios that look an awful lot like the market index itself. Investors in such funds might have been better off just buying the passive index through an ETF rather than paying the fees for an active manager to mimic it. When managers have a significant amount of skin-in-the-game, they are naturally incentivized to avoid such behavior.

Indeed, the authors of the new paper speculate that their new findings are explained by a similar phenomenon: “These results provide additional support for the model: inside investment funds are both smaller and outperform; suggesting that managers do not hit the limits of the capacity constraints of their investment strategy when their own private capital is deployed. The reluctance to accept additional outside capital on these funds explains why they continue to outperform and gain excess returns, even in equilibrium.”

We have been some of the biggest critics of the broader active management industry. We also want to offer a recent analysis by Vangard of 2,085 active equity funds over the past 15 years that suggests the odds of identifying successful managers is pretty small:

Figure 2: Portion of Active Funds that Survived and Outperformed over 15 Years (2000-2015)

However, this does not mean that active management cannot be a very fruitful form of investing or that it is difficult to identify investors that are likely to outperform. As the results of this new research suggest, insider investment may be a statistically significant and economically large predictor of hedge fund returns: “An investor who changes allocation from a fund with zero percent inside investment to one at the same firm with 100 percent inside investment would see a rise in excess returns of 36 basis points a month, or 4.3% annualized.”

We believe that if we are not willing to put our own money behind our ideas, we have no business asking LPs to do so. Personal investment is the ultimate arbiter of true incentive alignment and the surest safeguard against poor managerial decision making. Our business model and investment philosophy is to be the best in the world at executing niche, contrarian and capacity constrained strategies that are backed by both empirical evidence and philosophical theory.