Japan's Economic Recovery

Understanding the business cycle in Japan

By: Verdad Research

The US economy is now almost 5% bigger than in the fourth quarter of 2019 before the pandemic hit. But as of the third quarter of 2021, Japan’s economy has remained smaller than pre-pandemic levels.

Figure 1: US and Japan Real GDP Growth (2020–2021)

Source: FRED

Since 2018, Japan’s economy has lagged the US as Japan went through a series of recessions. The 2018 trade wars and, more recently, Japan’s sluggish easing of COVID restrictions with a delayed vaccine rollout have taken a toll on Japanese economic growth relative to the US. While most of the world began to ease restrictions in 2021, Japan remained in a heightened state of lockdowns. Even today, Japan remains one of the very few countries that still maintains significant restrictions on international business travel.

This divergence between the US economy and Japan’s is not unusual. Japan's economy is less correlated to the United States than one might expect: the correlation of US and Japan real GDP growth stands at 71%, compared to 88% for the US and the EU.

Given our work on the importance of economic growth to equity returns—and our careful study of Japanese equities, with 28 research notes on the market over the last six years—we wanted to delve deeper into Japan’s unique business cycles.

We have argued that the high-yield spread is the best metric for understanding the business cycle in the United States. But while the US and EU high-yield spreads are widely available indicators, this is not the case for Japan, where the high-yield bond market is virtually nonexistent. However, equity valuations, and particularly the valuations for small value stocks, are highly correlated to high-yield spreads internationally. Below, we compare the small value EBITDA yield spread (i.e., EBITDA/TEV minus 10-year Treasury yield) to the US high-yield spread.

Figure 2: US High-Yield and Small Value EBITDA Yield Spreads Level (1997–2021)

Source: Capital IQ, FRED, Verdad

The two series are 82% correlated. So periods of wide high-yield spreads tend to coincide with periods of when EBITDA multiples of small value stocks are low (i.e., EBITDA yields are high). This makes intuitive sense, as deep value stocks tend to be high-yield borrowers, so they get punished by the market for the risk associated with increasing borrowing costs.

We then looked at what the level and trend of the EBITDA yield spread can tell us about future returns. Below, we show the base rates for valuation levels (i.e., cheaper or more expensive relative to their five-year rolling median) and trend (i.e., rising or falling valuations on a three-month change basis).

Figure 3: Long-Run Valuations and Short-Run Trend Internationally (2000–2022)

Source: Capital IQ, Ken French cap-weighted indexes returns. Same standards applied to all three geographies on the same time horizon (2000–2022 for returns with trailing EBITDA yields extending back to 1995). Yield spread proxy manually calculated under the same standards for all listed stocks above $25M in each market every month for the 10th decile of deep value in each market.

Empirically, we can’t say much about Japan alone, given that quality data only extends back to the mid-1990s in Japan and the estimation error is extremely high. However, we have found that the core of this simple, intuitive model seems to replicate internationally, with suppressed multiples having predicted longer-term (three-year forward) returns, and positive trend having dictated shorter-horizon (one-month forward) returns.

Intuitively, betting on stocks when they’re very cheap but have positive price momentum makes sense to us. So, given the lack of a high-yield debt signal in Japan over the last few decades, we adapted our business cycle analysis to Japan using this EBITDA yield spread as a proxy for the high-yield spread indicator we use in the US.

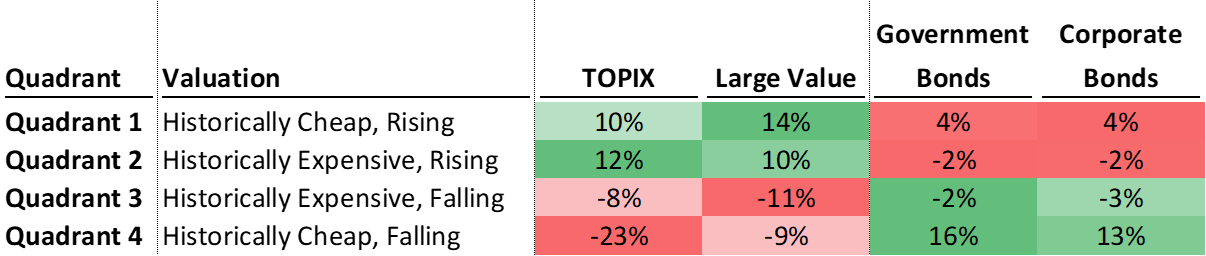

Figure 4: Business Cycle Quadrant Overview by EBITDA Yield Spread Level and Direction

Source: Verdad

We define the quadrants using EBITDA yield spreads adjusted for real GDP growth trends. This model produces results that mimic our findings using the high-yield spread in the US. Below, we show annualized average one-month forward returns by quadrant, since 2000. The below annualized returns serve the purpose of illustrating the performance differential across the business cycle. But implementing such a strategy can be difficult as investors would sometimes have to shift their portfolios in a short period of time based on the signal, which can be nearly impossible to execute with some asset classes, such as small value, but much easier with others, such as large value (which is shown below).

Figure 5: Annualized Average 1M FWD Returns by Business Cycle Quadrant (1995*–2020)

Source: Bloomberg, Capital IQ, FRED, Ken French Data Library, Verdad. *Or earliest available data.

This analysis is particularly important today due to the divergence we highlighted between the economic recovery from COVID in Japan versus other developed economies. High-yield spreads started widening in November 2021 in the US, marking the end of the COVID economic recovery and signaling the transition into a new phase of falling growth and rising inflation. But Japan has been in recession conditions for much of 2021. Below, we overlap the business cycle indicators in Japan (EBITDA yield spread) and the US (high-yield spread) over the course of the pandemic.

Figure 6: Japan and US Business Cycle Indicator Evolution (1/2020 – 1/2022)

Source: FRED, Capital IQ, Verdad

The EBITDA yield spread is at a similar level today as it was in March 2020, when the equity drawdown was at its worst. But historically what followed Quadrant 4 (the proxy for recession, the worst condition for small value equities) was Quadrant 1 (the proxy for recovery, which is the sweet spot for small value equity returns). And we’ve found that one quarter of rising GDP growth in Quadrant 4 typically preceded the switch into Quadrant 1, as one might expect. Japan just had a strong positive GDP growth print in the fourth quarter, which could suggest that the recovery is finally beginning.

Japan’s drawn-out COVID restrictions, almost a year past when other countries started to ease, have significantly held back their economic recovery. And this has been reflected in equity prices, especially for COVID-affected sectors. On an individual company basis, we can see dramatically different outcomes for restaurants, cosmetics companies, retailers, resorts, and event companies in the US versus Japan during the pandemic. Below are just a few that highlight that, in Japan, we certainly haven’t missed the cyclical COVID recovery enjoyed outside Japan.

Figure 7: Example of Japan Investment Opportunities

Source: Capital IQ, Verdad

Betting on the economy to rebound from COVID, making reopening trades, and buying value stocks have been winning strategies in the US since COVID. These trades have lagged in Japan, but we think Japanese economic conditions finally look poised to reward these bets as well. Below, we show average annual real GDP growth in the US and Japan since 1995, the earliest available data for Japan. We then compare those numbers with the consensus estimates for 2023, even if current events might see those estimates change significantly. While the estimated growth rates in the two regions are the same, the estimate in Japan is 4x higher than its long-term realized growth.

Figure 8: Comparative Annual Real GDP Growth (1995–2021, 2023)

Source: Bloomberg, FRED, Verdad

And we think valuations are more than supportive: January data shows the median TEV/EBITDA multiple in Japan was 6.2x, well below its historic average of 7.7x (this compares to 11.6x in the US, a 20% premium to its historic average of 9.7x). Expected returns for value stocks look particularly attractive, with the spread between value and growth stocks reaching 1999 and 2007 levels.

One note of caution. Even when Japan’s economy outperforms the US, the US market conditions can still be a drag on Japan’s stock market. Historically, Japanese equities have only outperformed in 40% of analogous historical conditions.

After an additional year of prolonged travel and business restrictions, the Japanese market is still well behind in its cyclical recovery from COVID. Given the restrictive COVID policies of the last year, multiples, margins, and prices remain uniquely subdued in Japan for now. But should Japan follow suit with the rest of the world this year in opening back up, the conditions seem ripe for a similar bet that already played out very well in other countries.