The Signal and the Noise

Stock markets are volatile. And Verdad’s investment strategy of buying small, cheap, leveraged companies is more volatile than the broader market.

Given this volatility, how do we separate skill from luck, signal from noise? How do we get comfortable that our strategy will work in an uncertain future?

We believe that the core driver of our returns is an ability to predict debt paydown among leveraged companies. We use a machine learning algorithm that was trained on 48 years of historical US data to forecast deleveraging among the stocks in our universe.

Below, we show the results of an out-of-sample test of this algorithm on European data over the past 20 years. Among the top decile of leveraged stocks, our algorithm is 65% accurate in predicting debt paydown over the next year. This is 15 percentage points better than a random guess, as the median stock in our universe has a 50% chance of paying down debt—much like a coin-flip.

Importantly, stocks that are more likely to deleverage also have higher returns going forward because they tend to be cheaper and have more debt to pay down at the time of investment.

Figure 1: Out-of-Sample Forecasts of Debt Paydown in Europe (Jun 1997 – Dec 2017)

Sources: Capital IQ and Verdad research

But how has this algorithm performed in live trading? After all, the most important out-of-sample test is implementation in live portfolios.

Below, we plot our live portfolio holdings by month since 2014, showing the percentage of companies that paid down debt in the subsequent twelve months versus the long-term historical average for all leveraged companies.

Figure 2: Verdad's Accuracy at Predicting Debt Paydown (Dec 2014 – Dec 2018)

Sources: Capital IQ and Verdad research

On average, 66% of the companies in our portfolio have paid down debt in each year since 2014. This proportion is in line with the 65% accuracy that our algorithm achieved in our out-of-sample backtests. Our algorithm works as expected in the most important out-of-sample test: live trading.

Moreover, the 66% of companies in our portfolio that deleveraged each year is significantly higher than the 50% historical average for all levered stocks. We are pleased to have a wide margin of improvement versus a random outcome.

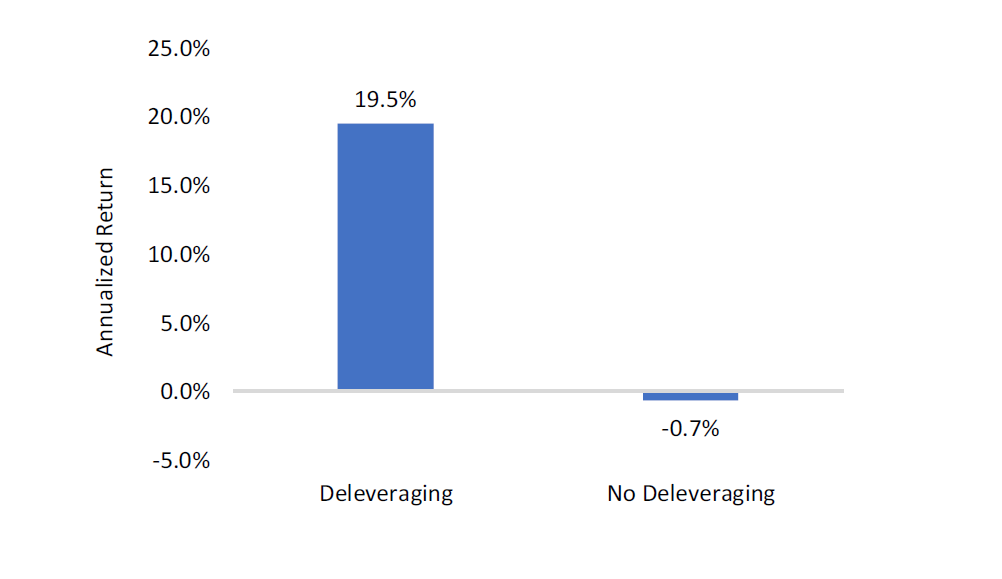

This is important because the companies in our portfolio that paid down debt had significantly higher returns than the companies that did not pay down debt.

Figure 3: Annualized Returns of Verdad Portfolio by Deleveraging Category (Dec 2014 – Dec 2018)

Sources: Capital IQ and Verdad research

We can predict deleveraging with a high degree of accuracy thanks to our machine-learning algorithm. And because deleveraging is a highly significant predictor of future equity returns, this lends a stability to our process—a signal in the noise.

What we cannot control—and what explains 80% of the volatility in stock prices—is changes in multiples. Long-term data support the idea that multiples revert to their mean over time. But in any given year, multiples tend to be driven by unpredictable market-wide forces. Below we show a graph of the proportion of our companies that saw improving multiples versus the global equity market return (as measured by the Vanguard Total World Index). These two time-series are 70% correlated, which means that multiple expansion or contraction in our portfolio is closely associated with the direction of the overall market.

Figure 4: Multiple Expansion in Verdad Holdings vs. Global Market Return (Dec 2014 – Dec 2018)

Sources: S&P Capital IQ and Verdad research

When markets are going up, a much higher proportion of our companies show improving multiples. When markets are going down, multiples contract. This is the noise around the signal of deleveraging.

In his New York Times bestselling book, The Signal and the Noise, Nate Silver describes why many predictions fail, but some don’t. The key differentiator is an understanding of uncertainty. Predictions that ignore probabilities—such as “the market will go down this year”—often fail because they do not account for the substantial amount of uncertainty in returns. On the other hand, predictions that are expressed in probabilistic terms—like “these stocks are 65% likely to pay down debt over the next year”—are more likely to succeed because they are informed by base rates and embrace uncertainty.

That is why our investment process at Verdad focuses on probabilities and draws on long series of historical data to measure base rates. Given the amount of noise in equity returns, we believe it is best to focus on a few logical and empirically robust signals: the likelihood of deleveraging among leveraged stocks, and the propensity of cheaper stocks to deliver higher returns over long horizons.