Does Activism Work?

Many attribute the high returns in private equity from 1980 to 2006 to the active role private equity firms took in managing their portfolio companies. We have expressed skepticism of the idea that “operational improvements” drove returns for private equity in the past.

But the idea of making money by improving companies is so hot that money is flooding not only into private equity but also into “activist” public equity funds. These activist funds promise to be the change investors wish to see in the market (to paraphrase a fake Gandhi quote). These hedge funds promise to provide their sage counsel to CEOs. Their methods range from friendly board involvement to polemical public PowerPoint presentations.

But do these funds really have superior judgment on how to run a business, and does their active involvement truly drive improvements in share price? A new paper by David Larcker, one of our favorite professors at Stanford, suggests the answer is no.

“We find that pre- to post-activism long-term returns insignificantly differ from zero,” write Larcker and his colleagues. “Using an appropriately matched sample, we find no evidence of abnormal post-activism performance improvements.” The paper concludes that a robust analysis of the data does not support the idea that activist interventions benefit shareholders in any way.

Previous research was more favorable to activists, but Larcker et al. find that the positive equal-weighted returns were driven by the smallest 20% of targets, which had an average market capitalization of $22M. Excluding these names eliminated the effect found in other research.

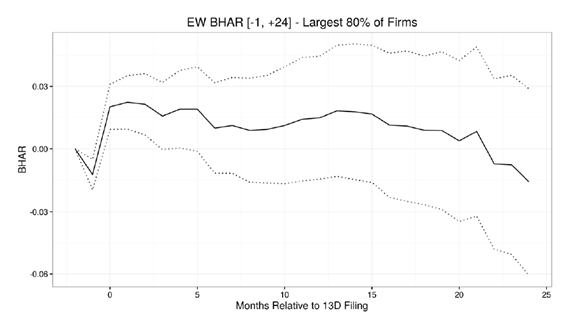

Larcker et al. find that activist filings cause an initial pop in share price, but returns become insignificant within three months of activism and are insignificantly negative (-1.6%) by the end of two years.

Figure 1: Buy and Hold Abnormal Return (BHAR) of Activist Targets

Source: Larcker et al. “Long-Term Economic Consequences of Hedge Fund Activist Interventions.”

There tends to be no significant improvement in share price because there tends to be no significant improvement in operations. The study looks at a wide variety of operating metrics and finds no evidence of improvements post intervention, nor does it find that analysts change their earnings expectations after activists get involved.

The study does find that “nearly all the positive long-term returns to activist interventions are concentrated among firms that are subsequently acquired.” Perhaps unsurprisingly, financiers succeed when they engineer a financial solution, in this case a buyout.

But activists don’t appear to have better judgment on how to run companies than the average public company CEO. This is in line with our findings on CEO characteristics. Bankers and consultants do not make better CEOs. MBAs don’t make better CEOs. There’s no magic bullet to higher returns that comes from better people or better strategy.

This new paper suggests that activism tends not to deliver on the promises of operational improvement or improved stock price returns. Investors may like the story of activist funds, the promise of making money by improving businesses, but the substance doesn’t seem to back up the story.