The Challenge of Diversification

The optimal diversifiers for an equity portfolio change too frequently

By: Chris Satterthwaite

For long-term investors, it’s hard to beat an all-equity portfolio. Over the last 50 years, equities have dominated the macro landscape as the best-performing asset class. Despite high volatility, the reward (~11% per year) has been worth the risk (~16% per year).

Yet the academic consensus, to borrow the quip credited to Nobel laureate Harry Markowitz, is that “diversification is the only free lunch in investing.” In theory, the bar should be low for a diversifying asset to add value to a portfolio: a modest positive return and low or negative correlation should do the trick.

To better understand the role diversifying assets should play in a portfolio, we built a set of 60/40 portfolios, taking a 60% equity portfolio and adding a 40% allocation to

international equities, REITs, gold, fixed income, a broad commodity basket, and a blend of L/S equity factors (value, quality, and momentum). The equity factor basket has no equity beta due to the long-short construction. We compared the returns of the 100% equity portfolio to these diversified portfolios.

In the vast majority of years (42 out of 50), at least one of these diversified portfolios outperformed a 100% US equity portfolio. The same is true in 7 out of 10 five-year periods. A 100% US equity portfolio performed best from 1995–1999, 2015–2019, and 2020–2024.

But over the full period, no diversifying portfolio beat the 100% equity approach in total returns. The reason? The winning diversifier changed too frequently.

The graph below compares the cumulative growth of $1 invested in a 100% US equity portfolio to a 60% US equity / 40% fixed-income portfolio over the past 50 years. The colored bars identify which diversifying portfolio had the best performance in each given year.

Figure 1: Diversified Portfolios vs. 100% US Equity and 60/40 US Equity/Credit

Sources: Bloomberg, Verdad analysis

The persistence of the best diversifier mix is relatively low and has been changing with increasing frequency. Prior to 2000, there were four instances in which the best-performing diversifier lasted for multiple years, with gold winning for three years and international equities for four. Since 2000, no diversifier has been the best performer for more than two years, and a two-year run has only happened twice (equity factors from 2000–2002 and gold from 2010–2012).

The best diversifier has varied widely over time. There was no single answer for a static, best diversifier to an equity-biased portfolio.

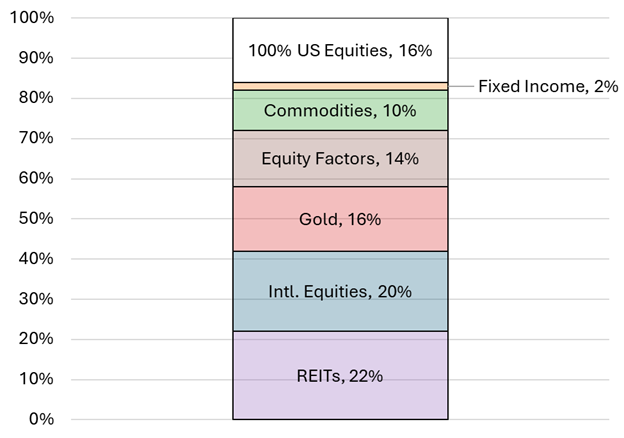

Figure 2: Share of years each diversifier was the best performer (1975–2025)

Sources: Bloomberg, Verdad analysis

This is, in part, due to changing correlations. Two notable examples of this include fixed income and gold, both of which exhibit extended periods of positive and negative correlation.

Figure 3: Rolling 5Y correlation of Fixed Income and Gold with a 100% US Equity Portfolio

Source: Bloomberg, Verdad analysis

The promise of diversification is higher returns with lower volatility. The challenge for investors is that the diversification value of the major investable alternative has varied widely over time, both as measured by ability to contribute to portfolio return and by correlation with equities.

Asset class diversification works well in theory, but for the return-maximizing investor the reality has been that benefitting from diversification has not been easy. The sources of diversifying returns have been too fickle. The challenge for the investor seeking to diversify outside of equities and improve portfolio returns, then, is to find a methodology for varying exposure to diversifiers based on macroeconomic regime and correlations. Developing such a methodology has been at the heart of Verdad's research and development agenda for years.