Sources of Return

Value and profitability offer complementary exposures.

By: Brian Chingono

In his seminal paper on the profitability factor, Robert Novy-Marx (2013) makes two important arguments about value and quality. Defining quality as high profitability in terms of Gross Profit/Assets, Novy-Marx first points out that “profitability is another dimension of value.” In this statement, Novy-Marx means that value and quality are philosophically and economically related because they both aim to purchase future streams of income at a discount today. While quality strategies purchase highly profitable firms at average prices, value strategies purchase average profitability firms at low prices. These two approaches are philosophically similar as they seek to benefit from multiple expansion over time as valuation discounts close in tandem with improved fundamentals.

The second major point in Novy-Marx’s paper is the paradoxical finding that while value and quality share a similar trading philosophy, “[highly] profitable firms are extremely dissimilar from value firms.” This dissimilarity is evidenced by a number of characteristics, from the spread in valuation ratios between quality and value to the low correlation of quality and value factor returns, at only 0.1 since 1963, according to Ken French data.

Below, we show that the dissimilarity between quality and value also extends to earnings growth. Whereas an annually rebalanced value strategy tends to have negative earnings growth over a one-year horizon, a quality strategy tends to have positive earnings growth over the same horizon. That is because value strategies rebalance into the cheapest stocks in the market, and these heavily discounted opportunities tend to be firms whose operations are in the process of stabilizing. On the other hand, quality strategies rebalance into highly profitable firms that are growing at an unremarkable pace of around 5% per year, which is broadly in line with long-term nominal GDP growth and is close to the market median growth rate.

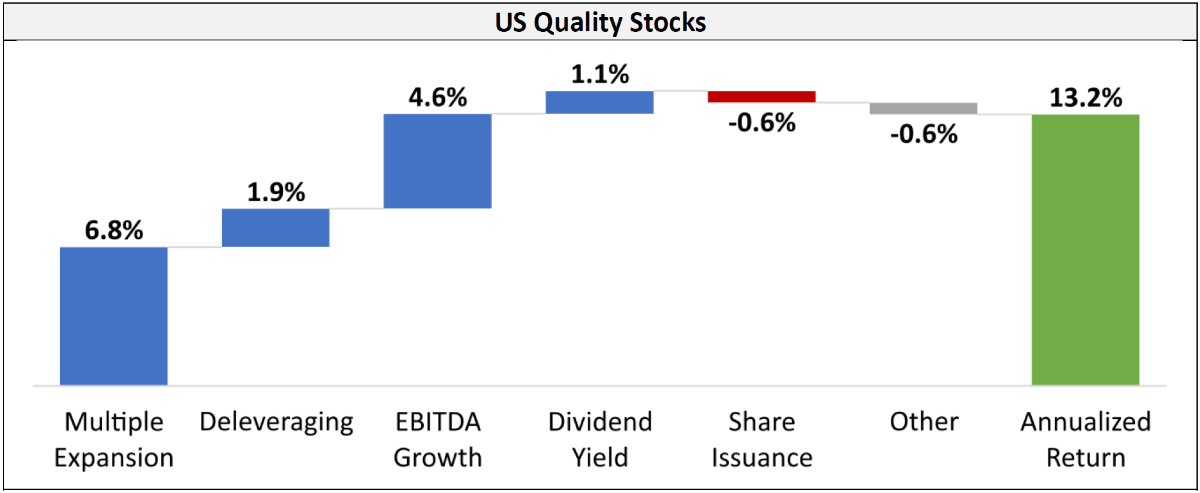

Figure 1: US Return Attributions for Value and Quality (1998–2021)

Source: S&P Capital IQ. The “Other” category accounts for aggregate rounding errors from the components. Equal-weight portfolios are formed with minimum market caps of $50 million.

We believe these charts provide a tidy synthesis of Novy-Marx’s two central points. Since value and quality strategies share a similar philosophy of buying companies at a discount to where they should be trading, they both benefit from multiple expansion. The magnitude of multiple expansion tends to be twice as large among value strategies at around 14%, versus 7% in quality, because the value firms are purchased at much lower valuations. Over the 23 years between 1998 and 2021, the cheapest 20% of US firms traded at a median valuation of 5.6x EV/EBITDA, whereas the most profitable 20% of US firms traded at a median valuation of 10x EV/EBITDA. These two portfolios are compared against the median characteristics across the US market in the table below. Relative to the market, quality works by purchasing double the amount of profitability in terms of Gross Profits/Assets and Operating Profit/Assets at roughly the same valuation multiples as the market. And value works by purchasing roughly the same level of profitability as the market at nearly half the valuation.

Figure 2: US Median Portfolio Characteristics (1998–2021)

Source: S&P Capital IQ. Equal-weight portfolios are formed with minimum market caps of $50 million.

While sharing a common trading philosophy, we believe the characteristic differences between value and quality mean that they are complementary in a portfolio because they work in different ways and at different times. Both strategies can offer a return premium to the market, with the equal-weight value portfolio outperforming the market by 3 percentage points per year since 1998 and the equal-weight quality portfolio outpacing the market by 2 percentage points per year over the same horizon, according to data from S&P Capital IQ. Therefore, we believe that value and quality are key ingredients in building a portfolio that targets long-term outperformance relative to the market.