Merger Arbitrage

Do risky deals pay?

By: Nick Sertl

Last year, Activision Blizzard’s shares jumped when Microsoft announced a deal to buy the company. But the shares remained well below Microsoft’s $95 offer price, and Activision investors could still receive an additional 20% return if the deal closed.

The market anticipated regulatory issues with the deal. And, one year later, the deal is still hung up in investigations by the FTC, the European Commission and other regulators. Historically, longer delays have predicted higher probabilities of cancellation, so Activision’s shares have fallen even further below the offer price.

Betting on mergers is a classic hedge fund arbitrage strategy. For a variety of reasons, we believe the stock price of acquisition targets usually trades slightly below the offer price and, given that about 90% of deals go through, we believe there’s a small premium to be earned. The bet, however, is negatively skewed, given the maximum that the arbitrageur can make is the spread, while the downside if the deal breaks can be large.

Funds targeting this strategy have generally produced a modestly correlated return stream that has outperformed bonds, according to our research. Below, we show the returns of the HFRI Merger Arbitrage hedge fund index (which, we’d note, is subject to reporting and survivorship bias) relative to the returns of the largest merger arbitrage mutual fund, the largest merger arbitrage ETF, and AQR’s Diversified Arbitrage mutual fund.

Figure 1: Return and Risk Characteristics over Last 10 Years

Source: Capital IQ, HFRI

To better understand this strategy, we built a database of 835 deals1 between 2000 and 2020, using data from Capital IQ. We employed a simple strategy: five days after the deal announcement, we go long the target. If the acquirer is paying in stock, we also short the acquirer in accordance with the exchange ratio. These positions are held until the deal either closes or fails. There are about 40 deals per year meeting our criteria; 89% of deals close successfully. The arbitrageur earns about 2.0% on the successful deals and loses 2.8% on cancelled deals for a blended average 1.5% return on long exposure if they were to bet on every merger. See summary stats below.

Figure 2: Performance of Data Set

Source: Capital IQ, Verdad analysis. Returns are expressed as a % of long exposure.

We believe the long position in the target generates all the returns for deals that close, while shorting the acquirer (if applicable) detracts, on average. However, for deals that break, the short acquirer position contributes 110bps, which we believe reduces the volatility of the return distribution.

Figure 3: Performance Breakdown

Source: Capital IQ, Verdad analysis. Returns are expressed as a % of long exposure.

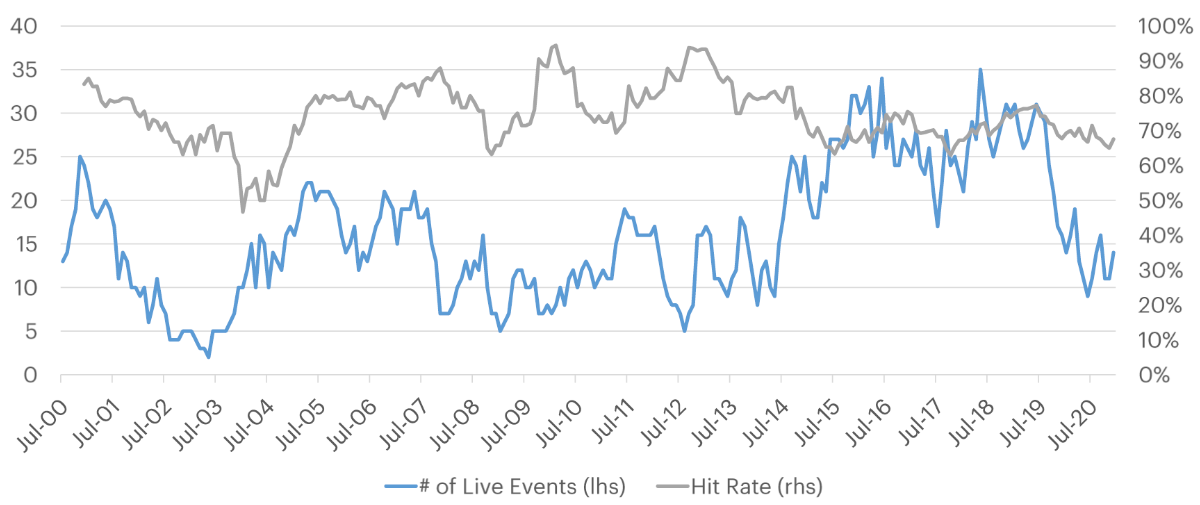

The merger arbitrage opportunity set is pro-cyclical. Below we show the number of concurrent live deals in our dataset over the past two decades. The maximum number is 35, while the minimum is just 2.

Figure 4: Number of Live Events and Hit Rate on Completed Deals

Source: Capital IQ, Verdad Analysis. Hit rate indicates % of completed deals that were profitable over a trailing 12M period.

As the strategy has gotten more crowded, spreads have declined. Rzakhanov and Jetley demonstrated that the ratio of merger arbitrage capital (liquidity supply) to aggregate deal value (liquidity demand) is a major determinant of the merger arbitrage spread. In a separate paper, Jetley and Ji showed—as reproduced in Figure 5—that the median merger arbitrage spread has decreased over time, both for completed and broken deals. It would be interesting to see if this trend has continued post-2007, but to our knowledge no such study exists. Other factors associated with low spreads include low interest rates, low transaction costs, and a permissive anti-trust environment.

Figure 5: Median Arbitrage Spreads for Successful Deals, 1990–2007

Source: Jetley and Ji

In our data, we found that high merger arb spreads are correlated with higher cancellation rates. In other words, the market discounts deals that are likely to fail by pricing the target lower. We examined whether the market is doing so efficiently by separating deals into different cohorts based on the target’s spread to the offer price one week after deal announcement.

Figure 6: Returns and Cancellation Rate by Spread Cohort

Source: Capital IQ, Verdad Analysis

Based on the data above, we believe deals with higher spreads generated higher returns, despite the drag caused by higher cancellation rates. Deals with spreads between 5% and 7.5% returned 4.0%, on average, while deals with spreads between 0% and 2.5% returned just 90bps. Deals with negative spreads are unattractive for merger arbitrageurs and produce negative returns, on average.

Our analysis shows that a deal’s merger arb spread, measured one week post deal announcement, and the high-yield spread predict whether that individual deal will close or not. According to a simple logistic regression, a 100bps increase in the high-yield spread is associated with an 80bps increase in the probability of deal cancellation, while a 100bps increase in the merger arb spread is associated with a 24bps increase in the likelihood of cancellation.

Figure 7: Trailing 12M Deal Cancellation Rate vs High-Yield Spreads

Source: Capital IQ, FRED

As a result, merger arb returns are negatively correlated with high-yield spreads. We believe higher spreads cause deal failure directly by making it more difficult and expensive for cash acquirers to secure financing. Higher spreads also indicate greater risk aversion and price volatility, which decreases the likelihood of risky acquisitions closing. When deals break, merger arbs lose money.

A merger arbitrage strategy might be quite beneficial to already diversified investors. Using Fidelity's merger arbitrage mutual fund as the basis for our return series, we found that the addition of merger arbitrage to an "all-weather" style portfolio could improve the Sharpe ratio by over 0.05 when used as a partial substitute for high-yield credit. This is because they have similar return profiles, but the merger arbitrage strategy was broadly less correlated with other assets—both equity and debt—than was high-yield. However, while we believe that quantitative models might be effective tools in identifying which mergers to invest in, we have not found good predictors for merger arbitrage as an asset class—at least not within our panel of the "usual suspects" of macroeconomic regressors. This contrasts unfavorably with high-yield credit, where there are strong predictors both cross-sectionally and at the asset class level. As a result, we believe it may make sense for long-run investors to use a merger arbitrage strategy as a partial substitute for high-yield.

Acknowledgment: Nick Sertl contributed to this piece. Nick recently joined Thorntree Capital Partners as an investment analyst.

Appendix

1 Deals needed to meet the following characteristics for inclusion in the data set:

Transaction >$100M

Include only deals with strategic buyers

Pricing data for both target and acquirer must be available

Close/cancel happens >1 week post deal announcement

Target and Acquirer are both US listed

Target is >5% and <200% of acquirer’s market cap

Removed SPAC deals and certain reverse mergers