M&A is a Seller's Market

Almost a third of our portfolio has engaged in material mergers and acquisitions activity in the first six months of 2017, with several of our companies being acquired at significant premiums. Given this frenzy of buying activity, we wanted to lay out the reasons we believe M&A may act as an accelerant on the small-cap market, a pro-cyclical form of capital allocation that brings big rewards for shareholders in acquired firms and disappointment to the optimistic acquirers.

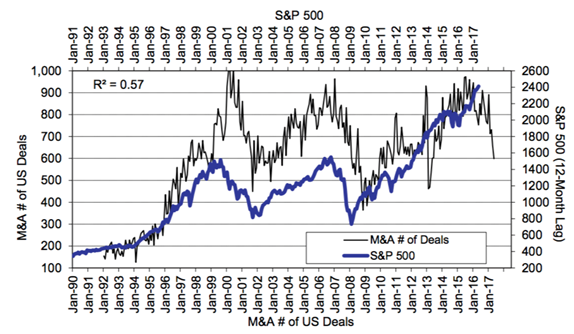

Alpha is a zero-sum game, and M&A is an example of alpha transfer from acquiring to acquired firms—and an excellent opportunity for small-cap investors who can select firms with a higher probability of being bought out. M&A activity is pro-cyclical, with more activity during expansions and less during contractions. Acquirers do deals when debt is cheap and optimism abounds.

Figure 1: Number of US M&A Deals vs S&P 500 (12-Month Lag)

Source: FactSet and Citi research – US Equity Strategy (Business Insider)

We found abundant evidence that M&A activity transfers wealth from acquiring to acquired firms. A meta-analysis conducted by David R. King et al. in 2004 analyzed 93 published studies and over 200,000 deals. Figure 2 shows the abnormal returns for acquired and acquiring firms, with day 0 indicating the date of the acquisition announcement. Only one event window exists for acquired firms because after the merger announcement they cease to exist independently. The data presents significant positive abnormal returns for acquired firms, while the returns to acquiring firms are only slightly positive or consistently negative.

Figure 2: Meta-Analysis of Financial Performance for Acquired and Acquiring Firms

*** indicates p < 0.001

This table shows a positive r for acquired and acquiring firms on Day 0, then negative returns consistent across robust sample sizes

If acquisitions can so often be unprofitable for the buyer, then why is M&A so popular?

Academics suggest the answer might be behavioral: the hubris of CEOs. A 1997 study examined the impact of CEO hubris on the acquisition premium paid by acquiring companies. Since there is no explicit metric for hubris, the study uses three proxies: recent organizational success; recent media praise for CEO; and CEO pay relative to other executives of the company. The study found that each of these variables is highly correlated with the value premium paid by a company. For every highly favorable article regarding the CEO, for example, the study found a 4.6% increase in premiums on average.

Indeed, a survey of CEO’s in 1998 found that the primary goals of M&A were pursuing market power and increasing profitability: creating shareholder value ranked third on the list. These CEOs may be prioritizing strategy over price discipline, and the more incentives they have to be hubristic, the more likely they may be to believe in these non-market rationales.

Making splashy acquisitions at big prices may get CEOs (and private equity firms) into the headlines, but the main beneficiaries of these decisions may actually be the owners of those small companies getting bought, not those that backed the acquirers.