Japan: The Island Investors Forgot

The pioneers of the endowment model in the 1970s sought to find investment opportunities that would diversify their portfolios while providing returns comparable to a balanced US stock-bond portfolio. We believe that their success in the decades that followed resulted from their savvy decision to go where others would not, to find underexploited opportunities with diversification benefits.

But today the traditional endowment model strategies—private equity, venture capital, long-short US equity funds—are all crowded and wildly competitive. As we discussed last week, many developed equity markets appear expensive based on current valuations. Their performance also tends to be highly correlated. So where should allocators now turn for cheap, underallocated assets that can provide portfolio diversification and higher expected returns?

We believe that one of the greatest opportunities in global markets today lies in Japan.

Japan is Underallocated

According to research by Eurekahedge, approximately 85% of the assets held by hedge funds are invested in North America and Europe. The hedge fund dollars invested in Japan are represented by the tiny orange slice in the left-hand panel of Figure 1 below. Japan appears to be underallocated within hedge fund portfolios, given the fact that the country represents 8% of global market capitalization.

Figure 1: Hedge Fund AUM by Investment Geography (left) and Country Market Cap (right)

At the 2018 Opalesque Roundtable Series on Japan, it was estimated that “there are over 10,000 hedge funds in the United States, and 32 hedge funds in Japan.” We believe that the limited competition in Japan presents an opportunity for contrarian investors.

Japan Offers Significant Diversification Benefits

Japan has a low correlation to other developed equity markets, which provides important diversification benefits. Figure 2 illustrates this point through a correlation matrix of the US equity market, developed markets outside of the US, the Fama-French Japanese Small Value index, and a backtest of our leveraged small value strategy in Japan. The returns in Figure 2 cover the 10-year period between August 2007 and December 2017. All information is presented in US dollars.

Figure 2: Diversification Benefits of Japan

Sources: Vanguard Total Stock Market ETF (“US Index”), Vanguard FTSE Developed Markets ETF (“Developed (ex US) Index”), Fama-French Japanese Small Value Index (“Japan Small Value Index”), and Verdad Japanese Levered Small Value Equity backtest (“Verdad Japan Strategy”)

The developed (ex US) index is weighted 54% in Europe, 38% in the Pacific, and 8% in Canada. Despite this geographic diversification, the developed (ex US) index was about 90% correlated with the US equity market. It also experienced worse drawdowns and underperformed the US equity market by 5.8 percentage points over the 10-year period. By contrast, investing in Japanese small value equities would have delivered an 11% average annual return with a much lower correlation relative to the US and other developed markets. Moreover, the Japanese small value index would have produced similar volatility and reduced drawdowns relative to other developed equity markets. The backtest of our leveraged small value strategy in Japan suggests higher returns of around 19% per year, with similar characteristics: lower correlation to other developed markets and reduced drawdowns.

In our view, the results shown in Figure 2 are not a surprising for our strategy, given the role that leverage plays in amplifying returns, coupled with the limited bankruptcy rate in Japan.

Leveraged Small Value in Japan Has Delivered Higher Returns

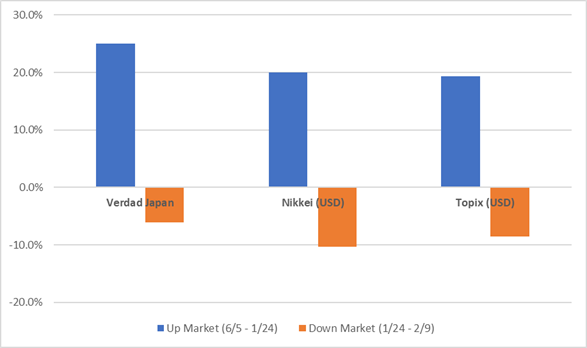

Most importantly, we observed that our strategy seems to have been significantly matching these predictions since the Verdad Japan Fund was launched in June 2017 in good markets and in bad. Since inception through February 9th, the Verdad Japan Fund has delivered ~20% net return, relative to ~10% in the Nikkei 225 and ~6% in the S&P 500 over the same period. Figure 3 displays how the fund has performed from our first day of trading after launch through the market peak around January 24th and how it has performed in the down market from January 24th through Friday, February 9th.

Figure 3: Verdad Japan Fund vs Nikkei 225 and TOPIX in the Recent Up and Down Markets

Source: Returns through February 8, 2018. Capital IQ for Nikkei 225 and Topix. Verdad Japan is net of fees.

In the recent market unpleasantness, which started around January 24 and lasted through February 9, Verdad Japan managed to decline by only about half the losses of the Nikkei and the TOPIX indexes in US dollars and the S&P 500 index.

At Verdad, we pursue a pure absolute returns strategy. That means we seek the best performance over long time horizons for our clients. However, we believe our leveraged small value strategy in Japan is uniquely suited to the objectives of investors who seek higher expected returns and lower correlations to their core portfolio holdings.