Inflation, Overvaluation and the Future of Diversification

Results of our asset allocation survey

By: Graham Infinger

Fears of rising inflation, rising rates, and overvalued equity markets topped the list of investor concerns in our first asset allocation survey, to which we are grateful to report over 500 readers responded.

Figure 1: Biggest Threats to Portfolio Performance in the Next Decade

Source: Verdad survey, N=514.

“How does an investor: 1) protect themselves from hyperinflation 2) appropriately value stocks and bonds when you are skeptical of valuations,” asked one reader, capturing the broader zeitgeist.

These fears—of overvaluation threatening equity returns and rising inflation and rates threatening bond returns—are logical given how our survey readers position their portfolios. The plurality of institutional investor readers who responded to our survey use an endowment model for asset allocation that is heavy on private equity and venture capital where valuations are perhaps most worrisome, while the plurality of individual investors who responded to our survey have 100% equity portfolios. The second most common choice for both is the 60/40 mix.

Figure 2: Asset Allocation Framework Used

Source: Verdad survey, N=514.

These traditional portfolio models have performed very well over the past decade, with the 60/40 portfolio achieving its highest trailing 10-year Sharpe ratio in decades and venture capital having its best decade since the 1990s. But this type of portfolio would have suffered in decades like the 1970s when inflation ran hot or the 2000s when equity valuations compressed. Preparing for such an environment might require significant changes to asset allocation, yet our survey suggests most investors change their portfolios relatively infrequently.

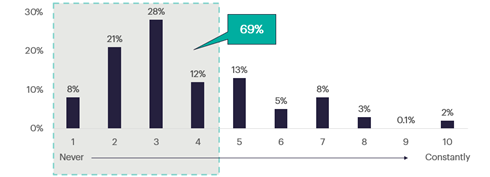

Figure 3: Frequency of Change to Your Asset Allocation Mix

Source: Verdad survey, N=514.

Our readers were struggling with how to position portfolios to thrive in a period of rising rates, rising inflation, or equity multiple compression. “I scratch my head as to where I should be positioned for the long term besides a diversified basket of equities,” wrote one reader. “Maybe I should add an allocation to ‘hard assets.’”

Concerns about equity overvaluation were paired with “fear of missing out,” as our readers noted that the US equity market has been richly valued for years yet still had phenomenal performance. “Is [the US equity market] a bubble? I don't know, but I think prices will probably keep rising,” wrote one reader. “How do you participate in the significant upside in high-performing assets despite their being overvalued w/o overexposing yourself to the inherent risk? What’s the balance, or is there one?” asked another.

Similarly, concerns about rising inflation were paired with reflections on prior inflation scares that turned out to be nothing. One reader identified his greatest challenge as “being hedged for inflation without ruining returns if it doesn’t happen.” Another asked, “How do you structure a portfolio that is robust to both inflation and deflation?”

Despite these reoccurring concerns, only small percentages of our readers use the strategies we believe are shown to best mitigate these risks. Trend following can help investors capture the run-up in richly valued assets while protecting against reversals, yet only about 15% of our readers employ trend following as an explicit strategy. Gold is one of the best returning assets in a rising inflation environment, yet only 18% of our readers have a greater than 5% allocation to gold in their portfolios.

Investors are asking these questions in service of two primary goals that resonated across our survey: absolute return and capital preservation.

Figure 4: Primary Goal of Asset Allocation

Source: Verdad survey, N=514.

While, at face value, these two goals seem at odds with one another (how can you obtain the highest absolute returns without taking on commensurate risk?), we largely agree with this. After all, if you are able to avoid large drawdowns in your portfolio through proper diversification and avoiding short-term shocks, it seems clear this would be accretive to total performance. But, given the uncertainty in an ever-changing world, how do you make sure these diversifying assets indeed perform as intended (i.e., as non-correlated diversifiers) and aren’t a net drag on absolute performance over the long run?

One of our readers eloquently expressed the challenge facing asset allocators. His biggest challenge, he wrote, was “how to apply time-tested long-run forecasting techniques to what appears to be a unique macroeconomy in the next decade.” His focus now was on “exploring asset classes and investment strategies where the underlying risk/return drivers are independent from and potentially diversify equity exposure, especially inflation protection strategies.”

These challenges faced by many inspire a few interesting questions in us that we would like to further explore. For example, if the next 10 years are going to look quite different from the last 10 years, should there be a measured response in how you approach your asset allocation? How might a tactical approach to at least a portion of an entity’s allocation framework address concerns regarding inflation risk and overvaluation risk?

In the coming weeks, we will attempt to explicitly address the challenges raised by many of you and offer our views on how you might address your concerns through your asset allocation. We hope you find our take interesting.