Do MBAs Make Better CEOs?

In the 1980s, Harvard Business School professor Michael Jensen noticed a big shift in the career choices of Harvard MBAs. In the late 1970s, about 55% of graduates chose careers in corporate management, but by the late 1980s, only 30% were making this choice.

Jensen was concerned that this meant that America’s “best and brightest” leaders were not going to be running America’s largest companies—and that corporate America needed to increase CEO compensation to lure more Harvard MBAs into corporate management careers. His ideas have been very influential in driving significant increases in executive compensation since the early 1990s. But was his logic correct?

A central premise of business education is that leadership and management can be taught in the classroom. Harvard Business School says its mission is “to educate leaders who make a difference in the world,” where a difference is defined as creating “real value for society.” And so, Jensen’s logic makes sense: Harvard attracts the very best students and, presumably, is good at educating them to be better business leaders, so corporate America should want more HBS graduates running companies—and this logic should extend to MBA programs beyond just Harvard.

We set out to test this logic empirically. We tested three key hypotheses that follow from Jensen’s logic:

The returns of companies run by CEOs with MBAs should outperform the returns of companies run by CEOs without MBAs. A market-neutral portfolio that goes long companies run by MBAs and short companies not run by MBAs should generate statistically significant alpha.

There should be a spread in quality of MBA programs. Some MBA programs should do a better job than others at selecting and training the future leaders of America. We should see the best-ranked MBA programs produce higher-quality CEOs as measured by share price performance.

Not all the “best and brightest” choose to get MBAs. Some choose to go to top consulting firms and investment banks—and these proving grounds for the managerial elite should produce CEOs with similar qualities to those of MBAs. Investing in companies run by former consultants and bankers should provide a replication of the core thesis that better credentialed CEOs should produce higher equity returns.

We share the results of each test below.

Do CEOs with MBAs generate higher returns for shareholders?

For an initial test of our first hypothesis, we formed monthly portfolios that go long companies with MBA CEOs and short companies headed by non-MBAs. Figure 1 below displays the outcome next to an equal-weighted S&P 500 index from 2000 to 2018.

Figure 1: Performance of Long MBA, Short Non-MBA Portfolio vs. S&P 500

Source: Verdad research

This backtested portfolio did not produce any statistically significant alpha and, in fact, had negative returns over the period tested. Admittedly, this was a net bull market for the S&P 500, so some might argue that comparing a long-only strategy to a long-short strategy is not appropriate. But there is clearly no alpha in the long-short strategy.

Do Elite MBA Programs Outperform?

This first test does not necessarily disprove Jensen’s logic. After all, not all MBA degrees are created equal. Post-crisis, even the most obnoxious elitist in Midtown knows to conceal his snobbery about schools. But elitism runs deep in the world of investing. After one too many drinks, he might ask: Why on earth would we mix the nitwits from, say, Northwestern together with the stars at HBS?

To test this hypothesis, we tagged CEOs by the MBA programs they attended. We expected to see the top MBA programs produce CEOs whose companies outperformed the market, whereas lower ranked MBA programs would fail to add value.

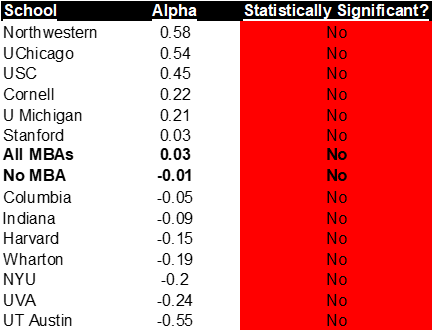

We formed monthly portfolios of companies broken down by the b-school each CEO attended. Figure 2 below displays these results and ranks each school by their alpha coefficient.

Figure 2: Equity Returns by CEO MBA Program

Source: Verdad research. Tests of significance included control variables for the market and size and value factors. 95% confidence intervals used for significance threshold.

We found no statistically significant alphas, despite testing every possible school with a reasonable sample size.

The perceived quality of each institution appeared to have no correlation with stock price returns. Northwestern led with an alpha of 0.58% per month. Stanford eked out a barely positive alpha of 0.03% per month. Harvard and Wharton had negative alphas of -0.15% and -0.19%, respectively, per month. While these rankings likely occurred by sheer chance, they do nothing to support Jensen’s thesis.

Our study is not the only one to come to this conclusion. A study by economists at the University of Hawaii asked similar questions and found that firm performance is not predicted by the educational background of the CEOs, except on a few “striking findings.” According to the Hawaiian upstarts, “The most striking finding from this [research] is that the top graduate and combined university (Harvard) is significantly negative in explaining ROI.”

Jensen would not be pleased. School rivalries run deep, even among objective data scientists. Some of the elitist "best and brightest," like Jensen and graduates of schools like his HBS, might critique the U. Hawaii researchers for bias in their “interesting,” “striking,” not to say “distinctly anti-Harvard” research findings. Given that the Verdad team has three MBAs and two Harvard degrees between us, we hope that we are beyond reproach on the potential bias question!

We were personally quite happy to learn that the study found that attending an MBA program dramatically increases the chances that someone becomes a CEO, even though the MBA has no predictive power for share price returns and thus the performance of the CEO.

Do CEOs from investment banks and elite consulting firms outperform?

Lastly, while not argued by Jensen, we looked at how CEOs who had previously worked at investment banks and elite consulting firms performed. If Jensen’s core thesis is true, we would expect CEOs with these elite credentials to outperform the market. So we hypothesized that this would provide further evidence that the “best and brightest” were indeed better managers.

We formed monthly portfolios for bankers and consultants. As we did before with MBAs, we then controlled for the confounding effects of size and value by running Fama-French three-factor regressions. Figure 3 below shows the results of this analysis.

Figure 3: Equity Returns for Bankers & Consultants

Source: Verdad research

Neither bankers nor consultants produced statistically significant alphas. We also backtested portfolios designed to favor ex-bankers and consultants and found no significant edge.

Conclusions

Our findings suggest that the “best and brightest” do not appear to have a statistically significant edge when it comes to managing public companies. An elite pedigree—the type of pedigree favored by head hunters and corporate boards—is not predictive of superior management. One of the central rationales for Michael Jensen’s campaign (increasing CEO pay by tying it to share price performance) appears, in retrospect, to have little empirical support. These credentials, however, are significantly overrepresented in the CEO biography database. The elite credentials thus benefit the individual, but there is little evidence that these credentials benefit shareholders.

It's unclear precisely why the evidence suggests that highly credentialed CEOs from our most elite MBA programs and their funnel careers appear to add no measurable value to shareholders. But we saw wisdom in the insight of the oldest living CEO, a 100-year-old billionaire from Singapore who still goes to work every day to mentor his son in leading the firm. His son, Teo Siong Seng, said, “But my father taught me one thing, in Chinese, it’s ‘yi de fu ren’—that means you want people to obey you, not because of your authority, not because of your power, or because you are fierce, but more because of your integrity, your quality, that people actually respect you and listen to you.” Bloomberg shows that “there is no education data available” for the 100-year-old CEO, Chang Yun Chung, so we cannot vet his educational credentials, but we suspect he did not obtain an MBA.