What does a yield buy?

It depends on the day. It makes more sense to ask what your credit quality pays.

By: Greg Obenshain

With the recent rise in rates, fixed income has become attractive once again. The 10-year Treasury pays a 4.1% yield, and the high-yield bond index pays a 7.9% yield. Clearly the rise in rates has dramatically changed the attractiveness of high yield, which yielded as little as 3.8% in June of 2021.

But what does it mean to buy a 7% yield? What does that get you? Well, much like Ben Graham’s famous manic-depressive Mr. Market, the bond market is manic as well. What it offers at 7% varies widely over time. One way to see this is to ask the question: “What credit quality could I buy for a 7% yield?” The answer is below.

Figure 1: What Credit Quality Does a 7% Yield Buy?

Source: Verdad Bond Database, Verdad Analysis. Assumes a hypothetical bond with 5 years to maturity (4.3 duration) and a 7% coupon. Bold lines are center of rating category, light lines correspond to notches (e.g., the bold BB line is BB, and the light line above is BB+).

There have been times when an investor could buy AAA quality for a 7% yield and times, such as June of 2021, when a 7% yield would buy a CCC quality bond. Just one quarter ago, in September 2023, a 7% yield would have bought you a BB+ credit, whereas today it buys you a B+ credit, three full credit notches lower.

While yield varies greatly across time, credit quality does not vary nearly as much. Below we show asset coverage (total assets divided by debt) of debt by rating category over time.

Figure 2: Asset Coverage by Rating Category

Source: Verdad Bond Database, Verdad Analysis. Median for the entire rating category (e.g., BB is for BB-, BB, and BB+)

In general, asset coverage is above 2.5x for the lowest level of investment-grade debt, BBB, above 2.0x for the highest level of high-yield debt, BB, and between 1.5x and 2.0x for the middle range of high-yield debt, single B. When you get a single B credit quality for a 7% yield, it really is something very different than getting a BBB credit quality.

What this brings to light is that targeting a yield makes very little sense because yield can mean very different things over time. In our opinion, it makes much more sense to target credit quality and ask: “What can I get paid for that credit quality?” But which credit quality? We could just look at the yield on the high-yield index, but that presents a problem. The high-yield index does not return its yield. You can see this by simply looking at what the high-yield bond index should have returned if it earned its yield every month versus what it has actually returned.

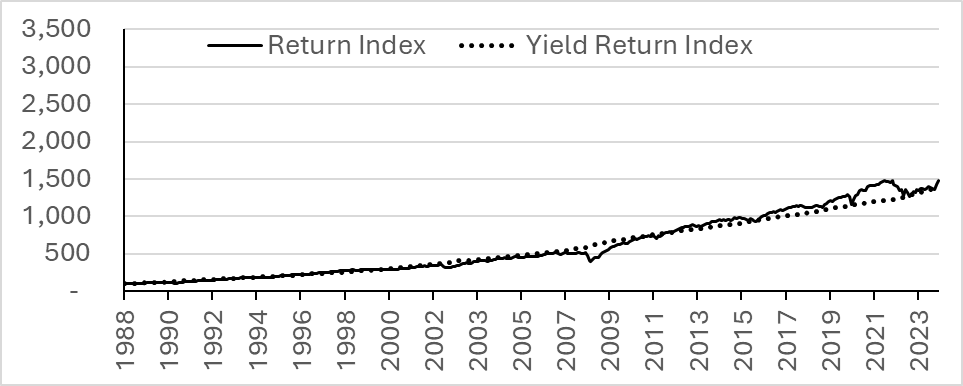

Figure 3: Return Index vs. Yield Return Index for High Yield

Source: Bloomberg, Verdad Analysis. Yield Return Index assumes the index earns its yield each month.

This is not true of the BB total return index, which does return its yield.

Figure 4: BB Bond Return Index vs. BB Yield Return Index

Source: Bloomberg, Verdad Analysis. Yield Return Index assumes the index earns its yield each month.

This leads to a good rule of thumb for high yield: while the yield on the high-yield index will be very similar to the yield on the single B index, the return on the high-yield index will be closer to the yield on the BB index. You can see this visually below. The high-yield index has yields similar to the single B index, but its returns track the returns on the higher-quality BB index.

Figure 5: High-Yield Index Yield and Return vs. Single B Yield and BB Return

Source: Bloomberg, Verdad Analysis. Yield Return Index assumes the index earns its yield each month.

The lower-yielding, higher-quality BB index is a better estimate of actual returns. We believe it is the best you are likely to do in liquid corporate credit. Below that, in the B and CCC indices, returns fail to keep up with yields, a phenomenon we’ve written about in “Fool’s Yield.”

So rather than target a 7% yield, or any other yield, perhaps the right question is: “What’s the best I can do in the liquid credit market?” The yield on the BB index is a good approximation. Right now, the BB index yields 6.6%. Meanwhile, the single B index yields 7.8% and the high-yield index yields 7.9%. Those are juicy 7% yields, but they are also less likely to be realized.