The Grocery Store Puzzle

Grocery stores have had a banner year, so why are their stocks underperforming?

The 2010s were a difficult decade for US grocery stores. Competition intensified as European discount grocery chains entered the US and Amazon bought Whole Foods. Smaller players like Dean Foods went bankrupt. Margins were thin, and unionized workforces and pension funds drained profits.

But COVID hit the grocery industry like an electric shock from a defibrillator. Over the past twelve months, EBITDA is up about 40% on average for publicly traded grocery chains, as evidenced in the chart below.

Figure 1: LTM EBITDA Growth

Source: Capital IQ

These companies came into this year heavily leveraged, and they used these windfall profits to delever by about $4B, or about 10% of aggregate market capitalization. They have also reinvested some of these profits in technology and facility upgrades, improving their abilities to work with grocery delivery companies like Instacart. Yet despite this massive growth, increased technology investment, and deleveraging, their stock prices have fared poorly, with only Weis Markets beating the US market index.

Figure 2: 2020 Grocery Store Equity Returns vs. US Market Index

Source: Capital IQ. Note: Albertsons relative return shown since IPO on June 25.

Why have the stocks done poorly despite tremendous growth? Simple. Multiple compression.

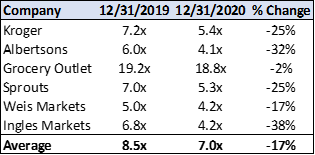

Investors seem to be convinced these are one-time windfall profits that don’t have a material impact on firm valuation. Investors think next year comps will be negative, everything will be about deceleration, they’ll be left with a razor-thin margin, and they'll be afflicted by the same litany of problems from the 2010s. Below is a table comparing EBITDA multiples at the beginning of the year to the present.

Figure 3: EBITDA Multiples over Time

Source: Capital IQ. Note: Albertsons shown since IPO on June 25.

Investors value the future income stream of these companies at significantly lower valuation multiples today than 12 months ago. There is a compelling logic to this derating, given that 2020 was obviously an unusually good year for grocery stores.

Yet consider another set of stocks, the so-called FANMAGs (Facebook, Apple, Netflix, Microsoft, Apple, and Google), which are also widely considered to be beneficiaries of the coronavirus pandemic. These companies grew EBITDA on average only 9%, yet the stock market rewarded them with 22% higher EBITDA multiples on average, driving the stock prices up 52% on average. These stocks now trade at an average of 30x EBITDA.

Why did multiples go up rather than come down? Investors believe that the tech companies’ 2020 growth represents an acceleration of a long-term trend, rather than a windfall profit. Therefore, they increased their valuations even as these companies demonstrated above-trend growth. A recent Wall Street Journal article argued that COVID had propelled companies into the future. “COVID has acted like a time machine: it brought 2030 to 2020,” an executive at Shopify told the Journal. “All those trends, where organizations thought they had more time, got rapidly accelerated.”

But in an excellent essay, growth investor Gavin Baker points out the weaknesses with applying this narrative only to ecommerce companies and ignoring the positive impact COVID has had on physical retailers like grocery stores. He argues that since Amazon acquired Whole Foods it has been clear that the future was omnichannel and that physical retail infrastructure was valuable. The problem was that physical retailers generally had trouble adapting to the digital side of things. COVID forced them to learn. “If most e-commerce companies have been pulled 1–3 years into the future in terms of their revenue, then the e-commerce businesses of most category leading brick and mortar retailers have been pulled 5–10 years into the future,” he writes. “COVID has permanently changed their destiny and driven significantly higher long term steady state FCF outcomes for them.”

The grocery store chains have dramatically improved their ability to do online ordering, grocery delivery, and in-store pickup. And there’s the potential that the demand for groceries has actually been structurally altered by work from home. One or two additional days working from home would mean a lot of revenue shifting from business lunch restaurants to grocery stores. And perhaps COVID has also taught people new skills or new habits and trained patterns of behavior that might not mean revert immediately after the vaccine.

Tech companies could show the profit mean reversion most investors expect grocery chains to demonstrate, or grocery store chains could demonstrate the “acceleration” effect Gavin Baker postulates, or things could happen exactly the way the market expects. The truth is we don’t know what the future will hold for grocery stores any more than we know what it will hold for the FANMAGs or Shopify. But we can see the power of narrative in the way the market has treated one set of COVID beneficiaries versus another, and we can see how that narrative has translated into wildly divergent stock price movements.