The Dollar Carry Trade

The “carry trade” was once a darling of sophisticated investors, earning steady returns with low volatility for nearly a decade leading up to the 2008 financial crisis. Investors borrowed in low–interest rate currencies to invest in high–interest rate currencies and pocketed the spread. Investors made a lot of money executing this simple trade as the cumulative returns chart shown below illustrates.

Figure 1: Carry Trade Cumulative Returns before Financial Crisis

Source: AtlasFX

But since the financial crisis, this once-profitable trade has not been working.

Figure 2: Carry Trade Cumulative Returns after Financial Crisis

Source: AtlasFX

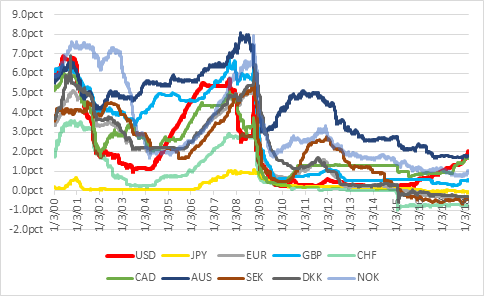

The problem is simple: interest rates have fallen so much everywhere that the spread between low–interest rate currencies and high–interest rate currencies isn’t big enough to drive much return. For example, the spread between the Japanese Yen (in yellow below) and the Australian dollar (in dark blue below) ranged from about 5% to 8% prior to 2008 but has been less than 3% since 2013.

Figure 3: Interest Rates across Currencies

Source: FRED

But since the Federal Reserve started raising US interest rates in 2015, the dollar has started to look like the best bet for carry traders. US interest rates are high compared to the extremely low (or negative) rates in countries like Japan or Switzerland. And unlike other investment currencies, the USD seems like a safe bet. Koji Fukaya, chief executive officer at FPG Securities Co. in Tokyo, expresses the conventional wisdom well: “The dollar and yen tend to be bought during risk aversion, so the dollar-yen could have smaller volatility than other yen crosses, which is conducive to carry trades,” he said. “That underscores the unique situation that we are in where the US economy is outperforming others and has the strongest upside to interest rates.”

But this creates a significant risk for the dollar. With so much money pouring into the US, most international currencies look undervalued relative to the dollar. The Economist's Big Mac Index suggests that the USD is at its highest value relative to fundamentals in 30 years and that almost every other currency is undervalued relative to the dollar. Some, like the Yen or the Pound, seem extremely undervalued.

Figure 4: Real Exchange Rate vs. US Dollar

Source: Colchester Global Investors

Investment currencies “go up by the stairs but go down with the elevator.” The investment currency appreciates relatively slowly as low capital mobility and funding illiquidity slow down the effect of higher demand for the investment currency. Then, traders protect the currency from depreciating by holding on to their positions or even expanding them. They do this because they don’t want to unwind their position until other investors do. But when investors’ risk tolerance goes down, traders will rapidly unwind their carry trade positions, causing a rapid depreciation of the investment currency.

Rapid depreciation of investment currencies causes massive drawdowns in the carry returns.

Figure 5: Top 10 Drawdowns from Currency Carry Trade Portfolios in Developed Market Currencies

Source: Michael Melvin and Duncan Shand. "When Carry Goes Bad: The Magnitude, Causes, and Duration of Currency Carry Unwinds."

Interestingly, carry trade unwinds and, consequently, carry trade drawdowns seem to be correlated to equity market movements. In periods of financial recessions (like the financial crisis in 2007 or the ERM crisis in 1992), the carry trade has its highest drawdowns. In fact, the carry trade has a strong positive correlation with equity markets.

Figure 6: Carry Trade and Equity Market Correlation

Source: FRED and AtlasFX

The USD, which is now an attractive investment currency for the carry trade, is thus exposed to crash risk that is highly correlated with the US equity market. In other words, it’s reasonable to expect that the next time the S&P 500 draws down, so too will the USD.

US investors might not feel this double pain as intensely given that they spend in dollars, but a prudent investor might well prefer to allocate capital to assets denominated in funding currencies that we might reasonably expect to hold up or even rise significantly in times of market stress, like the Japanese Yen and the Swiss Franc. The Japanese Yen appreciated 20–40% relative to assets in each of the top five carry trade currencies during the financial crisis in 2008.

Investors might also find it a relatively low-cost hedge to their portfolios to short investment currencies relative to funding currencies. Interest rate parity says that these currencies should depreciate, and the strong negative correlation with equity markets and risk assets means that this is potentially attractive as a negatively correlated exposure.

We tested this approach by blending short exposure to investment currencies with an investment in the S&P 500 and found that, historically, such a strategy would have significantly lowered volatility without much sacrifice in terms of returns.

Figure 7: Returns of Portfolios Shorting Investment Currencies Compared to S&P 500, 2000–2018

Source: Verdad research

The US dollar is used as an investment currency in the carry trade due to relatively higher interest rates, exposing itself to high crash risk. Investors with portfolios concentrated in US dollar–denominated investments should consider tools of hedging this currency risk such as investments in funding currencies like the Japanese Yen or the Swiss Franc.