No, It's Not a Good Idea

Robinhood traders buying bankrupt equities aren't onto something

Stuck at home amidst the COVID quarantines, bored punters have taken to gambling on the equities of bankrupt or near-bankrupt companies, where small retail flows can dramatically move prices.

Chesapeake Energy is planning to file for bankruptcy. The first-lien debt trades at 55 cents on the dollar, with the second-lien and unsecured bonds trading at between 2 and 8 cents on the dollar. But on June 8th, retail traders drove the price of the stock from $15 to $73 before it crashed back down to $24 on news coverage of the potential bankruptcy.

As specialists in leveraged equities, we are perhaps uniquely suited to comment on the merits of this strategy. We dug into our debt and equity databases and looked at the performance of stocks with bonds trading at distressed price levels. Below we show the cumulative annualized equity returns for strategies that simply pick equities based on the company’s bond trading price.

Figure 1: Equity Returns by Bond Trading Level

Source: Verdad bond database. Data for USD corporate high-yield and investment-grade bonds 12/31/96 – 5/30/20. Uses average bond price for unsecured bonds, secured bonds if no unsecured bonds, and subordinated bonds if no secured or unsecured bonds.

Verdict: it’s a very bad idea to buy the equity in companies where the bonds are distressed. Distress risk is not compensated. But what is particularly surprising to us is that it is also a bad idea to buy equity in companies with bonds trading below 90 cents on the dollar. Equity returns deteriorate very quickly with even a whiff of bankruptcy risk.

What about bond returns at these bond trading levels?

Figure 2: Bond Returns by Bond Trading Level

Source: Verdad bond database. Data for USD corporate high-yield and investment-grade bonds 12/31/96 – 5/30/20. Uses average bond price for unsecured bonds, secured bonds if no unsecured bonds, and subordinated bonds if no secured or unsecured bonds. Returns are average returns for all bonds of the issuer in the chosen seniority class.

As it turns out, it is also generally a bad idea to buy bonds trading below 70 cents on the dollar, with the potential exception being very distressed bonds trading below 10 cents, although we’d caution that the data for this segment is sporadic with very high variance. What is interesting to us about both of these charts is that bonds trading at par (100 cents on the dollar) signal higher returns in both stocks and bonds. The evidence suggests that returns come from strong credits.

But while the above confirms our long-held view that investors should avoid investing in companies on the verge of bankruptcy, the analysis is flawed, as bond prices fluctuate with macro-economic conditions—they are not a consistent measure of credit quality. To provide a more consistent measure of credit quality across time, below we show equity returns by market-implied ratings, which are the ratings implied by a bond’s trading level.

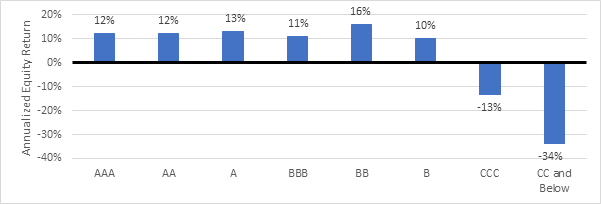

Figure 3: Equity Returns by Credit Quality

Source: Verdad bond database. Data for USD corporate high-yield and investment-grade bonds 12/31/96 – 5/30/20. Ratings are market-implied ratings estimated by Verdad but can be closely proxied using agency ratings.

Equity returns deteriorate when credit quality falls below the BB or high single-B quality level. As corporate credit returns peak in the BB quality category, so do equity returns. As is often pointed out, debt is a double-edged sword. It magnifies returns up to the point where it begins to magnify losses.

In an increasingly leveraged corporate sector, it is no longer possible to simply avoid companies with leverage. Equity investors need to understand when debt becomes dangerous. We believe simply checking the trading prices and credit ratings of a company can help equity investors avoid costly mistakes.