Insurance Float as Permanent Capital

In the depths of the financial crisis, Apollo Global Management decided to set up an insurance operation that would provide the firm permanent capital. Apollo took this new insurer, Athene, public in 2016 at a valuation of $9 billion.

With $87 billion in assets, Athene comprises 45% of Apollo’s total $192 billion AUM. Additionally, Apollo’s 12% stake in Athene currently comprises about 25% of Apollo’s total market capitalization.

Apollo is one of the most successful examples of money managers who have used insurance float as permanent investment capital. Warren Buffett pioneered this strategy, and it is believed that the majority of his outperformance as an investor comes from his use of float permanent capital with a negative interest rate.

Since the turn of the century, money managers such as Daniel Loeb and David Einhorn have created vehicles similar to Apollo’s Athene. Joseph Taussig, founder of Taussig Capital, which advises money managers, insurers, and reinsurers on such transitions, estimates 70 to 80 registered asset managers have set up insurance or reinsurance companies over the past decade to amplify their returns.

The experience of Buffett, Loeb, Einhorn, and others suggest that leveraging insurers’ unique structure may compound wealth at a substantially higher rate than a comparable investment fund.

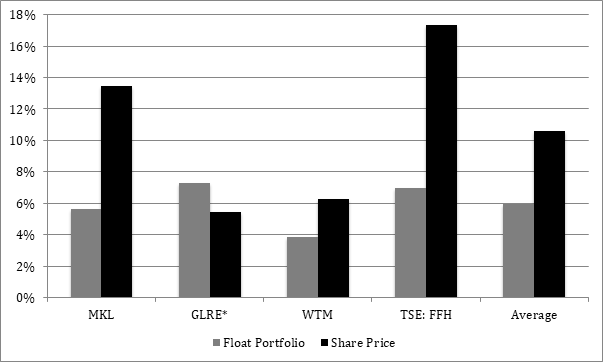

To test this hypothesis, we looked at the returns of four insurers known for their investment prowess. We compared the rate of growth in the insurers’ market capitalization to the return they were earning on their float portfolios.

Returns on equity outpaced the underlying investment portfolio by almost 80%. On average, investment portfolios returned 5.95% per year, while share prices appreciated an average of 10.62% a year, for a delta of 4.67%. These four insurers’ share prices have grown at a CAGR of 10.11% over the past 10 years, significantly beating the S&P500 at 4.9%.

Figure 1: CAGR of Representative Insurers’ Share Price vs Float Portfolios

Source: SEC filings, CapitalIQ

In addition to amplifying managers’ returns, investing via float instead of through a more traditional investment vehicle may offer investors a valuable tax advantage. Contrary to generally accepted accounting principles, insurers’ investment gains are not classified as investment income for statutory purposes. Thus, untaxed capital gains can continue compounding capital for investors, raising annual returns.

We believe that smart use of leverage is one of the best ways to improve long-term investment returns. Insurance float represents permanent capital with a negative interest rate. And it is no surprise that investors that have made use of this form of financing have been so successful.