How are Companies Handling the Crisis?

We asked 25 companies from our multifactor Crisis Investing model how COVID-19 is affecting business

By: Verdad Research

In our study, Crisis Investing, we examined eight economic crises from 1970 to today. While each crisis has its idiosyncrasies, we formulated three main quantitative takeaways for investors navigating uncertain environments. First, we identified high-yield spreads as a useful crisis indicator as they measure both economic consequences and gauge market sentiment. Second, we suggested that investors should begin deploying capital roughly three months after high-yield spreads have reached 6.5%, as they typically continue to rise. Finally, when deploying capital in a crisis, we found that returns are highest to illiquid, small-value equities with high asset turnover, positive net income, and strong free cash flow generation.

Since May, we have been actively investing based on this report and are also conducting extensive real-time research both to inform our investment decision making and to enable us to do a more effective post-mortem on this crisis. We wanted to share one of our initiatives with you: a survey of 25 companies that scored highly on the multifactor model described in our Crisis Investing study. These companies have a common quantitative profile: small, cheap, and leveraged. The average company surveyed has a market capitalization under $2B, trades at 6x EBITDA, is 3x levered, and offers a 24% FCF yield.

Our questioning fell along four primary dimensions:

Baseline business characteristics: we wanted to understand each management team’s perspective on their business and their long-term view for the prospects of their industry

Competitive environment: we sought to identify differences in strategy between a company and its peers

Uses of cash: we categorized each company based on their stated preferences for uses of cash generated by the business

COVID-19: we characterized both the severity of the virus’s impact on each company and the management team’s subsequent response

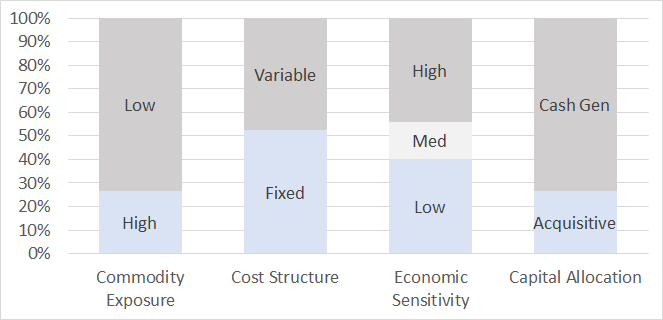

We asked each company the same set of questions. We then grouped the companies based on their responses to these questions into different categories: some management teams described their companies as highly sensitive to commodity prices, while others had limited commodity exposure, some companies had high fixed costs, others mostly variable costs, some had highly cyclical businesses whereas others were less cyclical, some businesses described an acquisitive capital allocation strategy while others were focused on debt repayment and cash flow generation. Figure 1 shows the distribution of companies on these characteristics.

Figure 1: Qualitative Attributes of Surveyed Companies

Source: Verdad

We will use this data to look at what is and is not working in real time – and to help improve our model for future crises. For example, one of the most interesting observations so far is the underperformance of less cyclical companies. Over the last two months, companies that described themselves as very cyclical are up an average of 23%, those that described themselves as moderately cyclical are up 7%, while companies that described themselves as less cyclical are actually down 4%.

There are no other statistically significant results yet, but we were interested to understand from these interviews how companies were navigating the crisis.

Management commentary around the virus also provides a fascinating snapshot of the state of corporate America as COVID-19 has unfolded. Some areas of the economy describe dire conditions. For instance, a representative for an automotive supplier commented, “The current crisis has everybody stressed. The reductions in automotive far surpass anything we’ve seen, including the Great Recession.”

Other respondents, however, have noted moderate-to-positive impacts. A representative for an insurer told us, “Working remotely has had significant implications for our cost structure. We plan to reduce our footprint by about 50% over the next five years with no planned adjustments to headcount. Our business is otherwise largely unaffected.” A homebuilder noted that “there has been a shortage in single-family housing for the last ten years, now this supply/demand imbalance has only been exacerbated by COVID.”

Of the firms we surveyed, 56% took measures to shore-up their liquidity position, 44% adjusted their workforce, and 16% adjusted wages and compensation.

So far, the characterized impact of COVID-19 has not had a statistically significant impact on stock price performance within our interview sample. We find these early results interesting and look forward to sharing insights as we continue to process results from the survey. We will continue to share how our real-time market assessments map to the retrospective predictions we made in our crisis investing study.

Acknowledgment: Verdad intern Lerato Takana contributed to this report. Originally from Lesotho, Lerato is a rising junior at Harvard, where he is studying mathematics. He is interested in pursuing a career in investing.