Equity Investing in Inflationary Environments

Turning a Bad Idea Around

By: Verdad Research

A great debate about inflation has been raging since early March. Ray Dalio has been sounding the alarm about an imminent inflation shock, while others have claimed these concerns are exaggerated.

It is hard to answer whether inflation is indeed transitory or here to stay. It is easier to analyze how inflation has historically impacted investors and what strategies have succeeded and failed in inflationary environments.

Campbell Harvey and researchers from Man Group have put out an excellent new paper that argues that commodities and certain active equity strategies—particularly quality and trend following—represent the best strategies for inflationary times.

Commodities are unique among major asset classes in that they perform better during periods of rising inflation and thus have a positive beta to inflation (i.e., the % move in their returns for each 1% move in annual inflation). All other major asset classes perform worse in inflationary environments and have a negative beta to inflation, as we concluded in our previous piece On Inflation and summarize below. The table below compares the performance of equities, fixed income, and commodities in periods of rising inflation versus the full period of the analysis, as well as their inflation beta.

Figure 1: Inflation Beta and Average Annualized Real Returns by Asset (1970–2020)

Source: Bloomberg, Ken French Data Library, Fred, Verdad. Periods defined monthly. We consider a period inflationary if the difference in annual inflation vs. the previous month is positive.

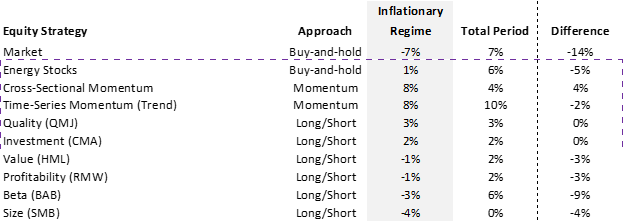

Commodities’ positive relationship to inflation is common knowledge. Harvey et al.’s paper is interesting and novel for its dissection of active equity strategies. They compare the market return to the return of various long/short active equity strategies. Below we summarize their findings and compare annualized real returns during inflationary regimes (as defined by the authors) to those over the full period of their analysis.

Figure 2: Annualized Real Returns by Equity Strategy (1926 or earliest available data – 2020)

Source: Exhibits 13, 14, 16, Harvey et al. Inflationary regimes are defined as times when CPI is accelerating and the level moves to 5% or more without having fallen below 50% of its maximum annual rate in rolling 24-month windows for at least six months (see paper for more detailed definition).

Harvey et al. find that trend and quality have been top performing strategies in inflationary regimes historically, as trend would have pushed investors out of stocks at the start of their drawdowns while high quality companies tend to be more resilient in bad times. In addition, energy stocks have also been a good bet in such periods, their performance likely supported by that of their underlying commodity, albeit energy stocks lagged energy futures by a significant margin. On the flipside, size (small minus big) was the worst performing strategy as, similarly to the quality effect, large companies tend to be more resilient in bad times.

We replicated these findings on our own data sets and came to similar conclusions.

To expand on the analysis, we wanted to explore a few different variations of the trend-following approach. We tested a simplified trend-following strategy: long the S&P 500 when the price is above its 200-day moving average and long a different asset otherwise. We tested four potential options for an alternative: short the S&P 500, long 10-year Treasurys, long gold futures, and long energy stocks. Below we compare the annualized real returns in periods of rising inflation versus the total period of the analysis.

Figure 3: Trend-Following Signal, Annualized Real Returns by Period and Approach (1970–2020)

Source: Verdad

Except for the long/short strategy, which does not seem to work with trend following, applying a 200-day moving average rule would have improved returns over the full period of the analysis compared to the buy-and-hold approach. Alternating between S&P 500 and gold futures would have improved the index performance most, especially in inflationary periods, followed by 10-year Treasurys. That said, when deciding between these two alternative assets, investors should also account for the associated drawdowns. While a gold futures strategy may offer the most improved returns during inflation, its max drawdowns historically approached 40%, double those of a strategy based on 10-year Treasurys.

Surprisingly, reallocating to energy stocks when the S&P 500 falls below its 200-day moving average price would have been detrimental to returns in inflationary periods. This is because 80% of the time such a strategy would have triggered an allocation to energy stocks precisely when trend would have also signaled poor future returns for this class.

Conclusion

We have read and conducted ample research suggesting that equities are poor performers during inflationary shocks. Despite the expectation that price increases can be passed on to end consumers, price stickiness, among other factors, makes sustained price hikes difficult. Our research supports the conclusions presented by Harvey et al., suggesting that allocating to quality or energy stocks, as well as applying a trend-following rule to equities, could offer relative protection to an equity portfolio in periods when inflation is rising.

That said, recent market events have only highlighted how swift and unpredictable the economy can be. Commodities are top performers in inflations, but a sudden switch to deflation can undermine those returns. Equities see some of their worst performance in inflationary environments but are great holdings over the long term. And fixed income, albeit a poor performer in inflations, could do wonders for a portfolio should a stagflation suddenly turn into a recession. So instead of asking what assets to own and when, a better question in this environment might be how to build the right mix of all three.